At A Glance

Annual Revenue Increase

Months Project Duration

Annual Profit Improvement

Annual Expense Reduction

A Strong Reputation Is Not Enough When Performance Lags

Our client had a strong reputation for legal excellence and zealous representation of their clients in pursuit of equitable outcomes. Despite professional success, the firm lacked visibility into which business segments created value and was hampered by outdated processes and systems that eroded revenue, increased cost, elevated risk, and distracted attorneys from client service.

At the recommendation of their bankers, they turned to P&C Global to help pivot the firm, accelerate its performance, and thereby ensure its legacy of outstanding legal advocacy.

P&C Global Calls for a Rigorous Transformation Program to Address Multiple Issues

P&C Global designed and implemented a comprehensive transformation program with these goals in mind:

- Optimize Business Mix: Shifting resources to the most profitable and highest future growth segments of the firm

- Increase Revenues: Growing both legal fees and effective, appropriate expense recovery

- Reduce Costs: Optimizing outlays related to technology, procured goods and services, and effective tax planning

- Manage Risk: Revamping the insurance portfolio including professional liability, property and casualty, employee health and wellness, addressing cybersecurity, and responding to pandemic impacts

- Build Capabilities: Developing processes, systems, and human capital

P&C Global Recommends and Implements Key Programs for Each Improvement Lever

P&C Global drove each of these workstreams on an agile basis, using mechanisms such as daily stand-up calls and remote collaboration tools to coordinate work and ensure progress across multiple organizations and functions. To ensure sustainable impact and continuous improvement, we upgraded the capabilities of the client’s leadership team by developing the skills non-attorneys who had potential but lacked requisite training, and identifying and replacing other staff members where required.

- Increase the ratio of junior to senior attorneys given their higher margins

- Shift legal staff towards practices with consistent track records and outlook for profitability

- Drive growth in focus practices through targeted marketing, business development, and potential openings in new strategic markets

- Use proven, effective technologies to streamline and maximize the recovery of client-related expenses including legal research, eDiscovery, and printing

- Consolidate and streamline eDiscovery solutions and processes to reduce hosting expenses while improving the effectiveness of case teams

- Redesign employee benefits plan and negotiate with carriers based on analysis of multi-year health claims and other actuarial data to develop a better plan at significantly less cost

- Reduce technology and other procurement spend categories by focusing on the total cost of ownership across the lifespan of agreements, identify and retire costly legacy systems, and consolidate spend across vendors to obtain better services at less cost

- Identify retroactive tax credits missed by legacy accountants and work with them to file amended tax returns to claim retroactive tax credits rightfully due to the client

- Streamline travel and expense management through a new integrated system including a new corporate credit card and IT solution to enable straight-through transaction processing to their financial system

- Perform comprehensive review of the insurance portfolio including Professional Liability, Property & Casualty, and Cyber Security policies, consolidating and replacing brokers and carriers as necessary to address coverage gaps while simultaneously reducing costs

- Harden IT infrastructure to mitigate the threat of network intrusion and data breach by locking down devices, replacing firewalls, cleansing account access permissions, updating password protocols, implementing multi-factor authentication, developing mobile device policies, purging obsolete data, and responding to incidents

- Develop and deploy standard compliance policies and procedures including Grants of Authority, Procurement, and Conflict Check workflows to reduce waste, duplicative spend, and missed expense recovery opportunities

- Respond to the COVID-19 pandemic by deploying a comprehensive suite of technologies to modernize document management and workforce collaboration systems while funding the program via available pandemic-related grants

- Develop a bespoke business analytics solution to enable equity partners to gain real time visibility into firm performance, as well as drill down into specific practices, cases, and timekeepers

- Implement modern Document Management System (DMS) to consolidate firm information onto a single, secure, accessible platform

- Create and deploy a revenue forecasting process to provide a systematic view of expected cash inflows by practice and case

- Restructure General Ledger and recompile historical results to provide a clear view of financial performance and trends by segment

- Deploy IT helpdesk case management system to maximize responsiveness and improve support to legal teams and staff

- Develop human capital by recruiting for critical staff positions and establishing customized learning and development agendas for select current employees

A Strong Reputation Is Not Enough When Performance Lags

Our client had a strong reputation for legal excellence and zealous representation of their clients in pursuit of equitable outcomes. Despite professional success, the firm lacked visibility into which business segments created value and was hampered by outdated processes and systems that eroded revenue, increased cost, elevated risk, and distracted attorneys from client service.

At the recommendation of their bankers, they turned to P&C Global to help pivot the firm, accelerate its performance, and thereby ensure its legacy of outstanding legal advocacy.

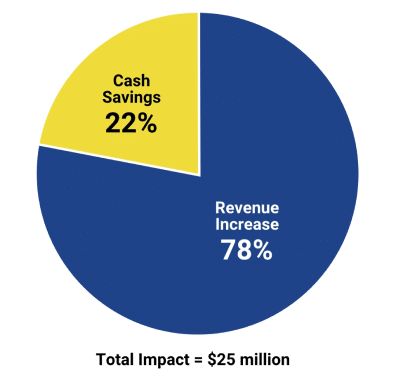

Transformation Program Results in $25M Annual Profit Increase

Taken together, these programs yielded an enormous benefit to the firm, generating $25 million in annual profitability improvements. The impacts were balanced, with roughly three-quarters stemming from revenue increases and the remainder from cost savings.

The improvements ensured that the transformation remained cash flow positive across our entire 18-month engagement. From the standpoint of our client’s leadership team, these benefits represent a near doubling of typical annual profits per equity partner.